Summary #

- Oracles are services that provide external data to a blockchain network.

- Solana has a rich ecosystem of oracle providers. Some notable oracle providers include Pyth Network, Switchboard, Chainlink, and DIA.

- You can build your own oracle to create a custom data feed.

- When choosing oracle providers, consider reliability, accuracy, decentralization, update frequency, and cost. Be aware of security risks: oracles can be potential points of failure or attack. For critical data, use reputable providers and consider multiple independent oracles to mitigate risks.

Lesson #

Oracles are services that provide external data to a blockchain network. Blockchains are siloed environments that do not inherently know the outside world. Oracles solve this limitation by offering a decentralized way to get various types of data onchain, such as:

- Results of sporting events

- Weather data

- Political election results

- Market data

- Randomness

While the implementation may differ across blockchains, oracles generally work as follows:

- Data is sourced offchain.

- The data is published onchain via a transaction and stored in an account.

- Programs can read the data stored in the account and use it in the program's logic.

This lesson will cover the basics of how oracles work, the state of oracles on Solana, and how to effectively use oracles in your Solana development.

Trust and Oracle Networks #

The primary challenge for oracles is trust. Since blockchains execute irreversible financial transactions, developers and users need to trust the validity and accuracy of oracle data. The first step in trusting an oracle is understanding its implementation.

Broadly speaking, there are three types of implementations:

-

Single, centralized oracle publishes data onchain.

- Pro: It's simple; there's one source of truth.

- Con: Nothing prevents the oracle provider from supplying inaccurate data.

-

Network of oracles publishes data, with consensus determining the final result.

- Pro: Consensus reduces the likelihood of bad data being pushed onchain.

- Con: There's no direct disincentive for bad actors to publish incorrect data to sway consensus.

-

Oracle network with proof-of-stake mechanism: Oracles are required to stake tokens to participate. If an oracle's response deviates too far from the consensus, its stake is taken by the protocol and it can no longer report.

- Pro: This approach prevents any single oracle from overly influencing the final result while incentivizing honest and accurate reporting.

- Con: Building decentralized networks is challenging; proper incentives and sufficient participation are necessary for success.

Each implementation has its place depending on the oracle's use case. For example, using centralized oracles for a blockchain-based game may be acceptable. However, you may be less comfortable with a centralized oracle providing price data for trading applications.

You may create standalone oracles for your own applications to access offchain data. However, these are unlikely to be used by the broader community, where decentralization is a core principle. Be cautious about using centralized third-party oracles as well.

In an ideal scenario, all important or valuable data would be provided onchain via a highly efficient oracle network with a trustworthy proof-of-stake consensus mechanism. A staking system incentivizes oracle providers to ensure the accuracy of their data to protect their staked funds.

Even when an oracle network claims to have a consensus mechanism, be aware of the risks. If the total value at stake in downstream applications exceeds the staked amount of the oracle network, there may still be sufficient incentive for collusion among oracles.

As a developer, it is your responsibility to understand how an oracle network is configured and assess whether it can be trusted. Generally, oracles should only be used for non-mission-critical functions, and worst-case scenarios should always be accounted for.

Oracles on Solana #

Solana has a diverse ecosystem of oracle providers, each with unique offerings. Some notable ones include:

- Pyth

Focuses primarily on financial data published by top-tier financial institutions. Pyth's data providers are approved entities that publish market data updates, which are then aggregated and made available onchain via the Pyth program. This data is not fully decentralized since only approved providers can publish it. However, the key advantage is that Pyth offers high-quality, vetted data directly sourced from these institutions. - Switchboard

Completely decentralized oracle network with a variety of data feeds. You can explore these feeds on Switchboard website. Anyone can run a Switchboard oracle or consume its data, but that means users need to be diligent in researching the quality of the feeds they use. - Chainlink

Decentralized oracle network providing secure offchain computations and real-world data across multiple blockchains. - DIA

Open-source oracle platform delivering transparent and verified data for digital assets and traditional financial instruments.

In this lesson, we'll be using Switchboard. However, the concepts are applicable to most oracles, so you should select the oracle provider that best fits your needs.

Switchboard follows a stake-weighted oracle network model, as discussed in the previous section, but with an additional layer of security via Trusted Execution Environments (TEEs). TEEs are secure environments isolated from the rest of the system where sensitive code can be executed. In simple terms, TEEs can take a program and an input, execute the program, and produce an output along with a proof. To learn more about TEEs, check out Switchboard's Architecture Design documentation.

By incorporating TEEs, Switchboard is able to verify each oracle's software, ensuring its integrity within the network. If an oracle operator acts maliciously or alters the approved code, the data quote verification process will fail. This allows Switchboard to support more than just data reporting; it can also run offchain custom and confidential computations.

Switchboard Oracles #

Switchboard oracles store data on Solana using data feeds, also called aggregators. These data feeds consist of multiple jobs that are aggregated to produce a single result. Aggregators are represented onchain as regular Solana accounts managed by the Switchboard program, with updates written directly to these accounts. Let's review some key terms to understand how Switchboard operates:

- Aggregator (Data Feed) - Contains the data feed configuration, including how updates are requested, processed, and resolved onchain. The aggregator account, owned by the Switchboard program stores the final data onchain.

- Job - Each data source corresponds to a job account, which defines the tasks for fetching and transforming offchain data. It acts as the blueprint for how data is retrieved for a particular source.

- Oracle - An oracle acts as the intermediary between the internet and the blockchain. It reads job definitions from the feed, calculates results, and submits them onchain.

- Oracle Queue - A pool of oracles that are assigned update requests in a round-robin fashion. Oracles in the queue must continuously heartbeat onchain to provide updates. The queue's data and configuration are stored in an onchain account managed by the Switchboard program.

- Oracle Consensus - Oracles come to a consensus by using the median of the responses as the accepted onchain result. The feed authority controls how many oracles are required to respond for added security.

Switchboard incentivizes oracles to update data feeds through a reward system.

Each data feed has a LeaseContract account, which is a pre-funded escrow that

rewards oracles for fulfilling update requests. The leaseAuthority can

withdraw funds, but anyone can contribute to the contract. When a user requests

a feed update, the escrow rewards both the user and the crank turners (those who

run software to systematically send update requests). Once oracles submit

results onchain, they are paid from this escrow.

Oracles must also stake tokens to participate in updates. If an oracle submits a

result outside the queue's configured parameters, they can have their stake

slashed, provided the queue has slashingEnabled. This mechanism ensures that

oracles act in good faith by providing accurate data.

How Data is Published Onchain #

-

Oracle Queue Setup - When an update request is made, the next

Noracles are assigned from the queue and moved to the back after completion. Each queue has its own configuration that dictates security and behavior, tailored to specific use cases. Queues are stored onchain as accounts and can be created via theoracleQueueInitinstruction.- Key

Oracle Queue configurations:

oracle_timeout: Removes stale oracles after a heartbeat timeout.reward: Defines rewards for oracles and round openers.min_stake: The minimum stake required for an oracle to participate.size: The current number of oracles in the queue.max_size: The maximum number of oracles a queue can support.

- Key

Oracle Queue configurations:

-

Aggregator/data feed setup - Each feed is linked to a single oracle queue and contains configuration details on how updates are requested and processed.

-

Job Account Setup - Each data source requires a job account that defines how oracles retrieve and fulfill the feed's update requests. These job accounts also specify where data is sourced.

-

Request Assignment - When an update is requested, the oracle queue assigns the task to different oracles in the queue. Each oracle processes data from the sources defined in the feed's job accounts, calculating a weighted median result based on the data.

-

Consensus and Result Calculation - After the required number of oracle responses (

minOracleResults) is received, the result is calculated as the median of the responses. Oracles that submit responses within the set parameters are rewarded, while those outside the threshold are penalized (ifslashingEnabledis active). -

Data Storage - The final result is stored in the aggregator account, where it can be accessed onchain for consumption by other programs.

How to Use Switchboard Oracles #

To incorporate offchain data into a Solana program using Switchboard oracles, the first step is to find a data feed that suits your needs. Switchboard offers many publicly available feeds for various data types. When selecting a feed, you should consider the following factors:

- Accuracy/Reliability: Evaluate how precise the data needs to be for your application.

- Data Source: Choose a feed based on where the data is sourced from.

- Update Cadence: Understand how frequently the feed is updated to ensure it meets your use case.

When consuming public feeds, you won't have control over these aspects, so it's important to choose carefully based on your requirements.

For example, Switchboard offers a

BTC/USD feed,

which provides the current Bitcoin price in USD. This feed is available on both

Solana devnet and mainnet with the following public key:

8SXvChNYFhRq4EZuZvnhjrB3jJRQCv4k3P4W6hesH3Ee.

Here's a snapshot of what the onchain data for a Switchboard feed account looks like:

// From the switchboard solana program

// https://github.com/switchboard-xyz/solana-sdk/blob/main/rust/switchboard-solana/src/oracle_program/accounts/aggregator.rs#L60

pub struct AggregatorAccountData {

/// Name of the aggregator to store onchain.

pub name: [u8; 32],

...

...

/// Pubkey of the queue the aggregator belongs to.

pub queue_pubkey: Pubkey,

...

/// Minimum number of oracle responses required before a round is validated.

pub min_oracle_results: u32,

/// Minimum number of job results before an oracle accepts a result.

pub min_job_results: u32,

/// Minimum number of seconds required between aggregator rounds.

pub min_update_delay_seconds: u32,

...

/// Change percentage required between a previous round and the current round. If variance percentage is not met, reject new oracle responses.

pub variance_threshold: SwitchboardDecimal,

...

/// Latest confirmed update request result that has been accepted as valid. This is where you will find the data you are requesting in latest_confirmed_round.result

pub latest_confirmed_round: AggregatorRound,

...

/// The previous confirmed round result.

pub previous_confirmed_round_result: SwitchboardDecimal,

/// The slot when the previous confirmed round was opened.

pub previous_confirmed_round_slot: u64,

...

}You can view the full code for this data structure in the Switchboard program here.

Some relevant fields and configurations on the AggregatorAccountData type are:

min_oracle_results- Minimum number of oracle responses required before a round is validated.min_job_results- Minimum number of job results before an oracle accepts a result.variance_threshold- Change percentage required between a previous round and the current round. If variance percentage is not met, reject new oracle responses.latest_confirmed_round- Latest confirmed update request result that has been accepted as valid. This is where you will find the data of the feed inlatest_confirmed_round.resultmin_update_delay_seconds- Minimum number of seconds required between aggregator rounds.

The first three configurations listed above directly impact the accuracy and reliability of a data feed:

-

The

min_job_resultsfield represents the minimum number of successful responses an oracle must receive from data sources before it can submit its response onchain. For example, ifmin_job_resultsis set to three, each oracle must pull data from at least three job sources. The higher this number, the more reliable and accurate the data will be, reducing the influence of any single data source. -

The

min_oracle_resultsfield is the minimum number of oracle responses required for a round to be successful. Each oracle in a queue pulls data from each source defined as a job, takes the weighted median of those responses, and submits that median onchain. The program then waits formin_oracle_resultsof these weighted medians and calculates the median of those, which is the final result stored in the data feed account. -

The

min_update_delay_secondsfield is related to the feed's update cadence. This value must have passed between rounds of updates before the Switchboard program will accept results.

It can help to view the jobs tab for a feed in Switchboard's explorer. For example, check out the BTC_USD feed in the explorer. Each job defines the data sources the oracles fetch from and the weight assigned to each source. You can view the actual API endpoints that provide the data for this feed. When selecting a feed for your program, these considerations are key.

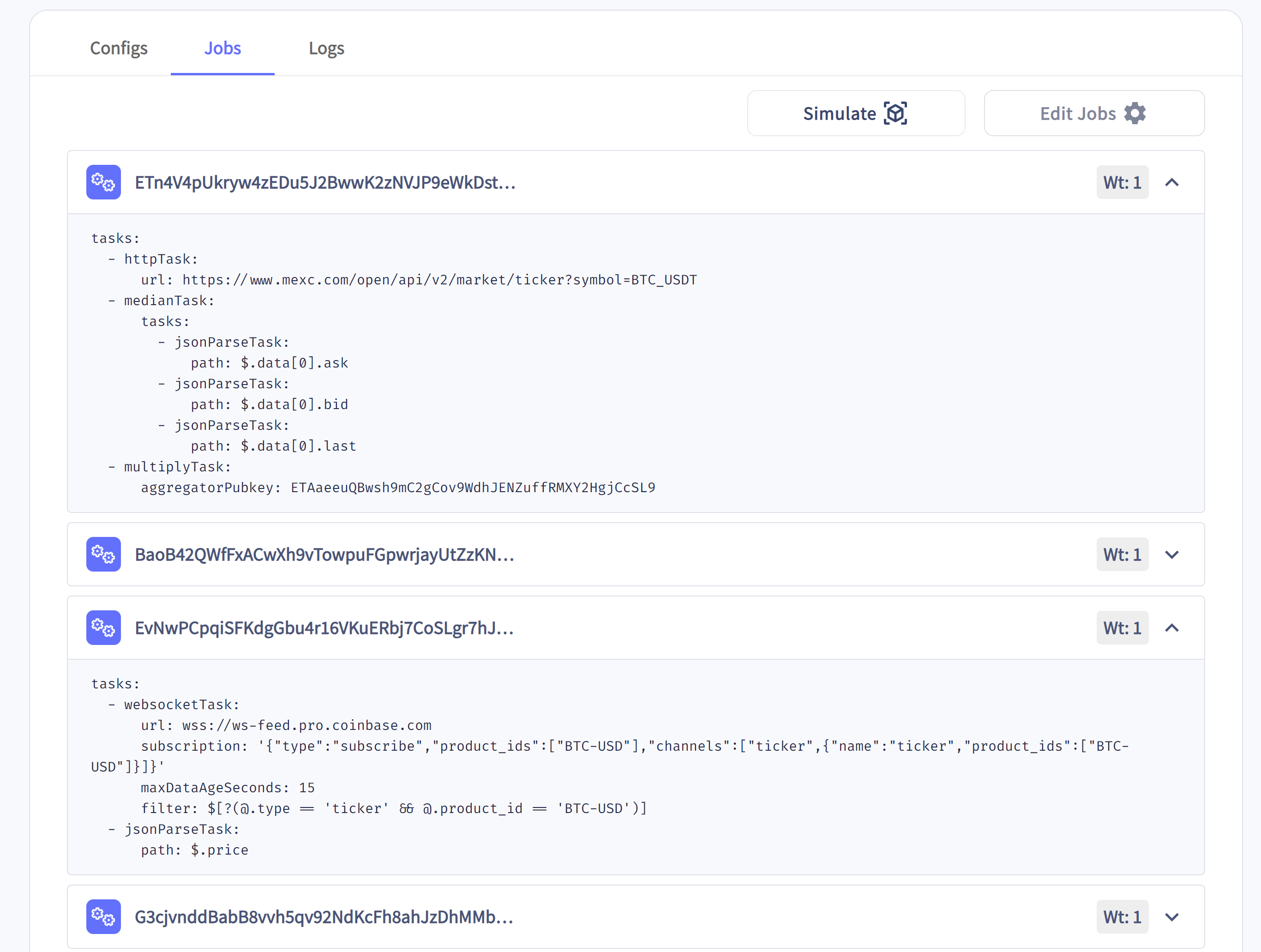

Below are two of the jobs related to the BTC_USD feed, showing data from MEXC and Coinbase.

Oracle Jobs

Oracle Jobs

Once you've chosen a feed, you can start reading the data from that feed by

deserializing and reading the state stored in the account. The easiest way to do

this is by using the AggregatorAccountData struct from the

switchboard_solana crate in your program.

// Import anchor and switchboard crates

use {anchor_lang::prelude::*, switchboard_solana::AggregatorAccountData};

...

#[derive(Accounts)]

pub struct ConsumeDataAccounts<'info> {

// Pass in data feed account and deserialize to AggregatorAccountData

pub feed_aggregator: AccountLoader<'info, AggregatorAccountData>,

...

}Using zero-copy deserialization with AccountLoader allows the program to

access specific data within large accounts like AggregatorAccountData without

loading the entire account into memory. This improves memory efficiency and

performance by only accessing the necessary parts of the account. It avoids

deserializing the whole account, saving both time and resources. This is

especially useful for large account structures.

When using AccountLoader, you can access the data in three ways:

load_init: Used after initializing an account (this ignores the missing account discriminator that gets added only after the user's instruction code)load: Used when the account is immutableload_mut: Used when the account is mutable

To dive deeper, check out the

Advanced Program Architecture lesson,

where we discuss Zero-Copy and AccountLoader in more detail.

With the aggregator account passed into your program, you can use it to retrieve

the latest oracle result. Specifically, you can use the get_result() method on

the aggregator type:

// Inside an Anchor program

...

let feed = &ctx.accounts.feed_aggregator.load()?;

// get result

let val: f64 = feed.get_result()?.try_into()?;The get_result() method defined on the AggregatorAccountData struct is safer

than fetching the data with latest_confirmed_round.result because Switchboard

has implemented some nifty safety checks.

// From switchboard program

// https://github.com/switchboard-xyz/solana-sdk/blob/main/rust/switchboard-solana/src/oracle_program/accounts/aggregator.rs#L206

pub fn get_result(&self) -> anchor_lang::Result<SwitchboardDecimal> {

if self.resolution_mode == AggregatorResolutionMode::ModeSlidingResolution {

return Ok(self.latest_confirmed_round.result);

}

let min_oracle_results = self.min_oracle_results;

let latest_confirmed_round_num_success = self.latest_confirmed_round.num_success;

if min_oracle_results > latest_confirmed_round_num_success {

return Err(SwitchboardError::InvalidAggregatorRound.into());

}

Ok(self.latest_confirmed_round.result)

}You can also view the current value stored in an AggregatorAccountData account

client-side in Typescript.

import { AggregatorAccount, SwitchboardProgram } from "@switchboard-xyz/solana.js";

import { PublicKey, SystemProgram, Connection } from "@solana/web3.js";

import { Big } from "@switchboard-xyz/common";

...

...

const DEVNET_RPC_URL = "https://api.devnet.solana.com";

const SOL_USD_SWITCHBOARD_FEED = new PublicKey(

"GvDMxPzN1sCj7L26YDK2HnMRXEQmQ2aemov8YBtPS7vR",

);

// Create keypair for test user

let user = new anchor.web3.Keypair();

// Fetch switchboard devnet program object

switchboardProgram = await SwitchboardProgram.load(

new Connection(DEVNET_RPC_URL),

payer,

);

// Pass switchboard program object and feed pubkey into AggregatorAccount constructor

aggregatorAccount = new AggregatorAccount(

switchboardProgram,

SOL_USD_SWITCHBOARD_FEED,

);

// Fetch latest SOL price

const solPrice: Big | null = await aggregatorAccount.fetchLatestValue();

if (solPrice === null) {

throw new Error("Aggregator holds no value");

}Remember, Switchboard data feeds are just accounts that are updated by third parties (oracles). Given that, you can do anything with the account that you can typically do with accounts external to your program.

Best Practices and Common Pitfalls #

When incorporating Switchboard feeds into your programs, there are two groups of concerns to consider: choosing a feed and actually consuming the data from that feed.

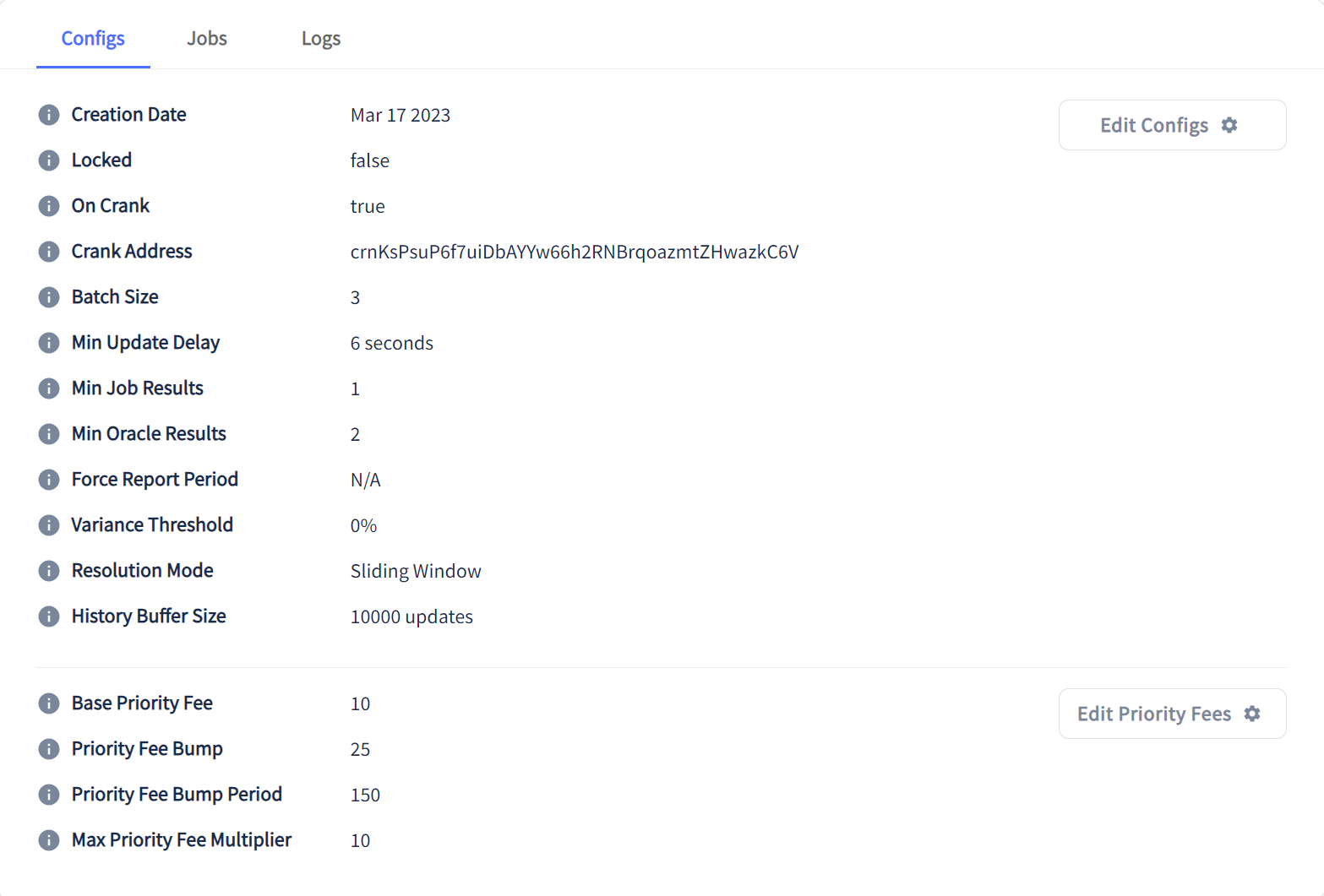

Always audit the configurations of a feed before deciding to incorporate it into a program. Configurations like Min Update Delay, Min job Results, and Min Oracle Results can directly affect the data that is eventually persisted onchain to the aggregator account. For example, looking at the config section of the BTC_USD feed you can see its relevant configurations.

Oracle Configs

Oracle Configs

The BTC_USD feed has a Min Update Delay = 6 seconds. This means that the price of BTC is only updated at a minimum of every 6 seconds on this feed. This is probably fine for most use cases, but if you wanted to use this feed for something latency sensitive, it's probably not a good choice.

It's also worthwhile to audit a feed's sources in the Jobs section of the oracle explorer. Since the value that is persisted onchain is the weighted median result the oracles pull from each source, the sources directly influence what is stored in the feed. Check for shady links and potentially run the APIs yourself for a time to gain confidence in them.

Once you have found a feed that fits your needs, you still need to make sure you're using the feed appropriately. For example, you should still implement necessary security checks on the account passed into your instruction. Any account can be passed into your program's instructions, so you should verify it's the account you expect it to be.

In Anchor, if you deserialize the account to the AggregatorAccountData type

from the switchboard_solana crate, Anchor checks that the account is owned by

the Switchboard program. If your program expects that only a specific data feed

will be passed in the instruction, then you can also verify that the public key

of the account passed in matches what it should be. One way to do this is to

hard code the address in the program somewhere and use account constraints to

verify the address passed in matches what is expected.

use {

anchor_lang::prelude::*,

solana_program::{pubkey, pubkey::Pubkey},

switchboard_solana::AggregatorAccountData,

};

pub static BTC_USDC_FEED: Pubkey = pubkey!("8SXvChNYFhRq4EZuZvnhjrB3jJRQCv4k3P4W6hesH3Ee");

...

...

#[derive(Accounts)]

pub struct TestInstruction<'info> {

// Switchboard SOL feed aggregator

#[account(

address = BTC_USDC_FEED

)]

pub feed_aggregator: AccountLoader<'info, AggregatorAccountData>,

}On top of ensuring the feed account is the one you expect, you can also do some checks on the data stored in the feed in your program's instruction logic. Two common things to check for are data staleness and the confidence interval.

Each data feed updates the current value stored in it when triggered by the oracles. This means the updates are dependent on the oracles in the queue that it's assigned to. Depending on what you intend to use the data feed for, it may be beneficial to verify that the value stored in the account was updated recently. For example, a lending protocol that needs to determine if a loan's collateral has fallen below a certain level may need the data to be no older than a few seconds. You can have your code check the timestamp of the most recent update stored in the aggregator account. The following code snippet checks that the timestamp of the most recent update on the data feed was no more than 30 seconds ago.

use {

anchor_lang::prelude::*,

anchor_lang::solana_program::clock,

switchboard_solana::{AggregatorAccountData, SwitchboardDecimal},

};

...

...

let feed = &ctx.accounts.feed_aggregator.load()?;

if (clock::Clock::get().unwrap().unix_timestamp - feed.latest_confirmed_round.round_open_timestamp) <= 30 {

valid_transfer = true;

}The latest_confirmed_round field on the AggregatorAccountData struct is of

type AggregatorRound defined as:

// https://github.com/switchboard-xyz/solana-sdk/blob/main/rust/switchboard-solana/src/oracle_program/accounts/aggregator.rs#L17

pub struct AggregatorRound {

/// Maintains the number of successful responses received from nodes.

/// Nodes can submit one successful response per round.

pub num_success: u32,

/// Number of error responses.

pub num_error: u32,

/// Whether an update request round has ended.

pub is_closed: bool,

/// Maintains the `solana_program::clock::Slot` that the round was opened at.

pub round_open_slot: u64,

/// Maintains the `solana_program::clock::UnixTimestamp;` the round was opened at.

pub round_open_timestamp: i64,

/// Maintains the current median of all successful round responses.

pub result: SwitchboardDecimal,

/// Standard deviation of the accepted results in the round.

pub std_deviation: SwitchboardDecimal,

/// Maintains the minimum node response this round.

pub min_response: SwitchboardDecimal,

/// Maintains the maximum node response this round.

pub max_response: SwitchboardDecimal,

/// Pubkeys of the oracles fulfilling this round.

pub oracle_pubkeys_data: [Pubkey; 16],

/// Represents all successful node responses this round. `NaN` if empty.

pub medians_data: [SwitchboardDecimal; 16],

/// Current rewards/slashes oracles have received this round.

pub current_payout: [i64; 16],

/// Keep track of which responses are fulfilled here.

pub medians_fulfilled: [bool; 16],

/// Keeps track of which errors are fulfilled here.

pub errors_fulfilled: [bool; 16],

}There are some other relevant fields that may be of interest to you in the

Aggregator account like num_success, medians_data, std_deviation, etc.

num_success is the number of successful responses received from oracles in

this round of updates. medians_data is an array of all of the successful

responses received from oracles this round. This is the dataset that is used to

derive the median and the final result. std_deviation is the standard

deviation of the accepted results in this round. You might want to check for a

low standard deviation, meaning that all of the oracle responses were similar.

The switchboard program is in charge of updating the relevant fields on this

struct every time it receives an update from an oracle.

The AggregatorAccountData also has a check_confidence_interval() method that

you can use as another verification on the data stored in the feed. The method

allows you to pass in a max_confidence_interval. If the standard deviation of

the results received from the oracle is greater than the given

max_confidence_interval, it returns an error.

// https://github.com/switchboard-xyz/solana-sdk/blob/main/rust/switchboard-solana/src/oracle_program/accounts/aggregator.rs#L228

pub fn check_confidence_interval(

&self,

max_confidence_interval: SwitchboardDecimal,

) -> anchor_lang::Result<()> {

if self.latest_confirmed_round.std_deviation > max_confidence_interval {

return Err(SwitchboardError::ConfidenceIntervalExceeded.into());

}

Ok(())

}You can incorporate this into your program like so:

use {

crate::{errors::*},

anchor_lang::prelude::*,

std::convert::TryInto,

use switchboard_solana::{AggregatorAccountData, SwitchboardDecimal},

};

...

...

let feed = &ctx.accounts.feed_aggregator.load()?;

// Check feed does not exceed max_confidence_interval

feed.check_confidence_interval(SwitchboardDecimal::from_f64(max_confidence_interval))

.map_err(|_| error!(ErrorCode::ConfidenceIntervalExceeded))?;Lastly, it's important to plan for worst-case scenarios in your programs. Plan for feeds going stale and plan for feed accounts closing.

Conclusion #

If you want functional programs that can perform actions based on real-world data, you'll need to use oracles. Fortunately, there are reliable oracle networks, such as Switchboard, that simplify the process. However, it's crucial to perform thorough due diligence on any oracle network you choose, as you are ultimately responsible for your program's behavior.

Lab #

Let's practice working with oracles! We'll be building a "Michael Burry Escrow" program, which locks SOL in an escrow account until its value surpasses a specified USD threshold. The program is named after Michael Burry, the investor known for predicting the 2008 housing market crash.

For this, we'll use the SOL_USD oracle on devnet from Switchboard. The program will have two key instructions:

- Deposit: Lock up the SOL and set a USD price target for unlocking.

- Withdraw: Check the USD price, and if the target is met, withdraw the SOL.

1. Program Setup #

To get started, let's create the program with

anchor init burry-escrow --template=multipleNext, replace the program ID in lib.rs and Anchor.toml by running command

anchor keys sync.

Next, add the following to the bottom of your Anchor.toml file. This will tell

Anchor how to configure our local testing environment. This will allow us to

test our program locally without having to deploy and send transactions to

devnet.

At the bottom of Anchor.toml:

[test]

startup_wait = 5000

shutdown_wait = 2000

upgradeable = false

[test.validator]

bind_address = "0.0.0.0"

url = "https://api.devnet.solana.com"

ledger = ".anchor/test-ledger"

rpc_port = 8899

[[test.validator.clone]] # switchboard-solana devnet programID

address = "SW1TCH7qEPTdLsDHRgPuMQjbQxKdH2aBStViMFnt64f"

[[test.validator.clone]] # switchboard-solana devnet IDL

address = "Fi8vncGpNKbq62gPo56G4toCehWNy77GgqGkTaAF5Lkk"

[[test.validator.clone]] # switchboard-solana SOL/USD Feed

address = "GvDMxPzN1sCj7L26YDK2HnMRXEQmQ2aemov8YBtPS7vR"Additionally, we want to import the switchboard-solana crate in our

Cargo.toml file. Make sure your dependencies look as follows:

[dependencies]

anchor-lang = "0.30.1"

switchboard-solana = "0.30.4"Before diving into the program logic, let's review the structure of our smart

contract. For smaller programs, it's tempting to put all the code in a single

lib.rs file. However, organizing the code across different files helps

maintain clarity and scalability. Our program will be structured as follows

within the programs/burry-escrow directory:

└── burry-escrow

├── Cargo.toml

├── Xargo.toml

└── src

├── constants.rs

├── error.rs

├── instructions

│ ├── deposit.rs

│ ├── mod.rs

│ └── withdraw.rs

├── lib.rs

└── state.rsIn this structure, lib.rs serves as the entry point to the program, while the

logic for each instruction handler is stored in separate files under the

instructions directory. Go ahead and set up the architecture as shown above,

and we'll proceed from there.

2. Setup lib.rs #

Before writing the logic, we'll set up the necessary boilerplate in lib.rs.

This file acts as the entry point for the program, defining the API endpoints

that all transactions will pass through. The actual logic will be housed in the

/instructions directory.

use anchor_lang::prelude::*;

use instructions::{deposit::*, withdraw::*};

pub mod errors;

pub mod instructions;

pub mod state;

pub mod constants;

declare_id!("YOUR_PROGRAM_KEY_HERE");

#[program]

pub mod burry_escrow {

use super::*;

pub fn deposit(ctx: Context<Deposit>, escrow_amount: u64, unlock_price: f64) -> Result<()> {

deposit_handler(ctx, escrow_amount, unlock_price)

}

pub fn withdraw(ctx: Context<Withdraw>) -> Result<()> {

withdraw_handler(ctx)

}

}3. Define state.rs #

Next, let's define our program's data account: Escrow. This account will store

two key pieces of information:

unlock_price: The price of SOL in USD at which withdrawals are allowed (e.g., hard-coded to $21.53).escrow_amount: Tracks the amount of lamports held in the escrow account.

use anchor_lang::prelude::*;

#[account]

#[derive(InitSpace)]

pub struct Escrow {

pub unlock_price: f64,

pub escrow_amount: u64,

}4. Constants #

Next, we'll define DISCRIMINATOR_SIZE as 8, the PDA seed as "MICHAEL BURRY",

and hard-code the SOL/USD oracle pubkey as SOL_USDC_FEED in the constants.rs

file.

pub const DISCRIMINATOR_SIZE: usize = 8;

pub const ESCROW_SEED: &[u8] = b"MICHAEL BURRY";

pub const SOL_USDC_FEED: &str = "GvDMxPzN1sCj7L26YDK2HnMRXEQmQ2aemov8YBtPS7vR";5. Errors #

Next, let's define the custom errors we'll use throughout the program. Inside

the error.rs file, paste the following:

use anchor_lang::prelude::*;

#[error_code]

#[derive(Eq, PartialEq)]

pub enum EscrowErrorCode {

#[msg("Not a valid Switchboard account")]

InvalidSwitchboardAccount,

#[msg("Switchboard feed has not been updated in 5 minutes")]

StaleFeed,

#[msg("Switchboard feed exceeded provided confidence interval")]

ConfidenceIntervalExceeded,

#[msg("Current SOL price is not above Escrow unlock price.")]

SolPriceBelowUnlockPrice,

}6. Setup mod.rs #

Let's set up our instructions/mod.rs file.

pub mod deposit;

pub mod withdraw;7. Deposit #

Now that we have all of the boilerplate out of the way, let's move on to our

Deposit instruction. This will live in the /src/instructions/deposit.rs

file.

When a user deposits, a PDA should be created with the "MICHAEL BURRY" string and the user's pubkey as seeds. This ensures that a user can only open one escrow account at a time. The instruction should initialize an account at this PDA and transfer the SOL that the user wants to lock up to it. The user will need to be a signer.

Let's first build the Deposit context struct. To do this, we need to think

about what accounts will be necessary for this instruction. We start with the

following:

use crate::constants::*;

use crate::state::*;

use anchor_lang::prelude::*;

use anchor_lang::solana_program::{program::invoke, system_instruction::transfer};

#[derive(Accounts)]

pub struct Deposit<'info> {

#[account(mut)]

pub user: Signer<'info>,

#[account(

init,

seeds = [ESCROW_SEED, user.key().as_ref()],

bump,

payer = user,

space = DISCRIMINATOR_SIZE + Escrow::INIT_SPACE

)]

pub escrow_account: Account<'info, Escrow>,

pub system_program: Program<'info, System>,

}Notice the constraints we added to the accounts:

- Because we'll be transferring SOL from the User account to the

escrowaccount, they both need to be mutable. - We know the

escrow_accountis supposed to be a PDA derived with the “MICHAEL BURRY” string and the user's pubkey. We can use Anchor account constraints to guarantee that the address passed in actually meets that requirement. - We also know that we have to initialize an account at this PDA to store some

state for the program. We use the

initconstraint here.

Let's move onto the actual logic. All we need to do is to initialize the state

of the escrow account and transfer the SOL. We expect the user to pass in the

amount of SOL they want to lock up in escrow and the price to unlock it at. We

will store these values in the escrow account.

After that, the method should execute the transfer. This program will be locking

up native SOL. Because of this, we don't need to use token accounts or the

Solana token program. We'll have to use the system_program to transfer the

lamports the user wants to lock up in escrow and invoke the transfer

instruction.

pub fn deposit_handler(ctx: Context<Deposit>, escrow_amount: u64, unlock_price: f64) -> Result<()> {

msg!("Depositing funds in escrow...");

let escrow = &mut ctx.accounts.escrow_account;

escrow.unlock_price = unlock_price;

escrow.escrow_amount = escrow_amount;

let transfer_instruction =

transfer(&ctx.accounts.user.key(), &escrow.key(), escrow_amount);

invoke(

&transfer_instruction,

&[

ctx.accounts.user.to_account_info(),

ctx.accounts.escrow_account.to_account_info(),

ctx.accounts.system_program.to_account_info(),

],

)?;

msg!(

"Transfer complete. Escrow will unlock SOL at {}",

&ctx.accounts.escrow_account.unlock_price

);

Ok(())

}That's is the gist of the deposit instruction handler! The final result of the

deposit.rs file should look as follows:

use crate::constants::*;

use crate::state::*;

use anchor_lang::prelude::*;

use anchor_lang::solana_program::{program::invoke, system_instruction::transfer};

pub fn deposit_handler(ctx: Context<Deposit>, escrow_amount: u64, unlock_price: f64) -> Result<()> {

msg!("Depositing funds in escrow...");

let escrow = &mut ctx.accounts.escrow_account;

escrow.unlock_price = unlock_price;

escrow.escrow_amount = escrow_amount;

let transfer_instruction =

transfer(&ctx.accounts.user.key(), &escrow.key(), escrow_amount);

invoke(

&transfer_instruction,

&[

ctx.accounts.user.to_account_info(),

ctx.accounts.escrow_account.to_account_info(),

ctx.accounts.system_program.to_account_info(),

],

)?;

msg!(

"Transfer complete. Escrow will unlock SOL at {}",

&ctx.accounts.escrow_account.unlock_price

);

Ok(())

}

#[derive(Accounts)]

pub struct Deposit<'info> {

#[account(mut)]

pub user: Signer<'info>,

#[account(

init,

seeds = [ESCROW_SEED, user.key().as_ref()],

bump,

payer = user,

space = DISCRIMINATOR_SIZE + Escrow::INIT_SPACE

)]

pub escrow_account: Account<'info, Escrow>,

pub system_program: Program<'info, System>,

}8. Withdraw #

The Withdraw instruction will require the same three accounts as the Deposit

instruction, plus the SOL_USDC Switchboard feed account. This code will be

placed in the withdraw.rs file.

use crate::constants::*;

use crate::errors::*;

use crate::state::*;

use anchor_lang::prelude::*;

use anchor_lang::solana_program::clock::Clock;

use std::str::FromStr;

use switchboard_solana::AggregatorAccountData;

#[derive(Accounts)]

pub struct Withdraw<'info> {

#[account(mut)]

pub user: Signer<'info>,

#[account(

mut,

seeds = [ESCROW_SEED, user.key().as_ref()],

bump,

close = user

)]

pub escrow_account: Account<'info, Escrow>,

#[account(

address = Pubkey::from_str(SOL_USDC_FEED).unwrap()

)]

pub feed_aggregator: AccountLoader<'info, AggregatorAccountData>,

pub system_program: Program<'info, System>,

}Notice we're using the close constraint because once the transaction completes,

we want to close the escrow_account. The SOL used as rent in the account will

be transferred to the user account.

We also use the address constraints to verify that the feed account passed in is

actually the usdc_sol feed and not some other feed (we have the SOL_USDC_FEED

address hard coded). In addition, the AggregatorAccountData struct that we

deserialize comes from the Switchboard rust crate. It verifies that the given

account is owned by the switchboard program and allows us to easily look at its

values. You'll notice it's wrapped in a AccountLoader. This is because the

feed is actually a fairly large account and it needs to be zero copied.

Now let's implement the withdraw instruction handler's logic. First, we check if

the feed is stale. Then we fetch the current price of SOL stored in the

feed_aggregator account. Lastly, we want to check that the current price is

above the escrow unlock_price. If it is, then we transfer the SOL from the

escrow account back to the user and close the account. If it isn't, then the

instruction handler should finish and return an error.

pub fn withdraw_handler(ctx: Context<Withdraw>) -> Result<()> {

let feed = &ctx.accounts.feed_aggregator.load()?;

let escrow = &ctx.accounts.escrow_account;

let current_sol_price: f64 = feed.get_result()?.try_into()?;

// Check if the feed has been updated in the last 5 minutes (300 seconds)

feed.check_staleness(Clock::get().unwrap().unix_timestamp, 300)

.map_err(|_| error!(EscrowErrorCode::StaleFeed))?;

msg!("Current SOL price is {}", current_sol_price);

msg!("Unlock price is {}", escrow.unlock_price);

if current_sol_price < escrow.unlock_price {

return Err(EscrowErrorCode::SolPriceBelowUnlockPrice.into());

}

....

}To finish the logic off, we will execute the transfer, this time we will have to

transfer the funds in a different way. Because we are transferring from an

account that also holds data we cannot use the system_program::transfer method

like before. If we try to, the instruction will fail to execute with the

following error.

'Transfer: `from` must not carry data'To account for this, we'll use try_borrow_mut_lamports() on each account and

add/subtract the amount of lamports stored in each account.

// Transfer lamports from escrow to user

**escrow.to_account_info().try_borrow_mut_lamports()? = escrow

.to_account_info()

.lamports()

.checked_sub(escrow_lamports)

.ok_or(ProgramError::InsufficientFunds)?;

**ctx

.accounts

.user

.to_account_info()

.try_borrow_mut_lamports()? = ctx

.accounts

.user

.to_account_info()

.lamports()

.checked_add(escrow_lamports)

.ok_or(ProgramError::InvalidArgument)?;The final withdraw method in the withdraw.rs file should look like this:

use crate::constants::*;

use crate::errors::*;

use crate::state::*;

use anchor_lang::prelude::*;

use anchor_lang::solana_program::clock::Clock;

use std::str::FromStr;

use switchboard_solana::AggregatorAccountData;

pub fn withdraw_handler(ctx: Context<Withdraw>) -> Result<()> {

let feed = &ctx.accounts.feed_aggregator.load()?;

let escrow = &ctx.accounts.escrow_account;

let current_sol_price: f64 = feed.get_result()?.try_into()?;

// Check if the feed has been updated in the last 5 minutes (300 seconds)

feed.check_staleness(Clock::get().unwrap().unix_timestamp, 300)

.map_err(|_| error!(EscrowErrorCode::StaleFeed))?;

msg!("Current SOL price is {}", current_sol_price);

msg!("Unlock price is {}", escrow.unlock_price);

if current_sol_price < escrow.unlock_price {

return Err(EscrowErrorCode::SolPriceBelowUnlockPrice.into());

}

let escrow_lamports = escrow.escrow_amount;

// Transfer lamports from escrow to user

**escrow.to_account_info().try_borrow_mut_lamports()? = escrow

.to_account_info()

.lamports()

.checked_sub(escrow_lamports)

.ok_or(ProgramError::InsufficientFunds)?;

**ctx

.accounts

.user

.to_account_info()

.try_borrow_mut_lamports()? = ctx

.accounts

.user

.to_account_info()

.lamports()

.checked_add(escrow_lamports)

.ok_or(ProgramError::InvalidArgument)?;

Ok(())

}

#[derive(Accounts)]

pub struct Withdraw<'info> {

#[account(mut)]

pub user: Signer<'info>,

#[account(

mut,

seeds = [ESCROW_SEED, user.key().as_ref()],

bump,

close = user

)]

pub escrow_account: Account<'info, Escrow>,

#[account(

address = Pubkey::from_str(SOL_USDC_FEED).unwrap()

)]

pub feed_aggregator: AccountLoader<'info, AggregatorAccountData>,

pub system_program: Program<'info, System>,

}And that's it for the program! At this point, you should be able to run

anchor build without any errors.

9. Testing #

Let's write some tests. We should have four of them:

- Creating an Escrow with the unlock price below the current SOL price so we can test withdrawing it

- Withdrawing and closing from the above escrow

- Creating an Escrow with the unlock price above the current SOL price so we can test withdrawing it

- Withdrawing and failing from the above escrow

Note that there can only be one escrow per user, so the above order matters.

We'll provide all the testing code in one snippet. Take a look through to make

sure you understand it before running anchor test.

// Inside tests/burry-escrow.ts

import * as anchor from "@coral-xyz/anchor";

import { Program, AnchorError } from "@coral-xyz/anchor";

import { BurryEscrow } from "../target/types/burry_escrow";

import { Big } from "@switchboard-xyz/common";

import {

AggregatorAccount,

AnchorWallet,

SwitchboardProgram,

} from "@switchboard-xyz/solana.js";

import { PublicKey, SystemProgram, Connection } from "@solana/web3.js";

import { assert } from "chai";

import { confirmTransaction } from "@solana-developers/helpers";

const SOL_USD_SWITCHBOARD_FEED = new PublicKey(

"GvDMxPzN1sCj7L26YDK2HnMRXEQmQ2aemov8YBtPS7vR",

);

const ESCROW_SEED = "MICHAEL BURRY";

const DEVNET_RPC_URL = "https://api.devnet.solana.com";

const CONFIRMATION_COMMITMENT = "confirmed";

const PRICE_OFFSET = 10;

const ESCROW_AMOUNT = new anchor.BN(100);

const EXPECTED_ERROR_MESSAGE =

"Current SOL price is not above Escrow unlock price.";

const provider = anchor.AnchorProvider.env();

anchor.setProvider(provider);

const program = anchor.workspace.BurryEscrow as Program<BurryEscrow>;

const payer = (provider.wallet as AnchorWallet).payer;

describe("burry-escrow", () => {

let switchboardProgram: SwitchboardProgram;

let aggregatorAccount: AggregatorAccount;

before(async () => {

switchboardProgram = await SwitchboardProgram.load(

new Connection(DEVNET_RPC_URL),

payer,

);

aggregatorAccount = new AggregatorAccount(

switchboardProgram,

SOL_USD_SWITCHBOARD_FEED,

);

});

const createAndVerifyEscrow = async (unlockPrice: number) => {

const [escrow] = PublicKey.findProgramAddressSync(

[Buffer.from(ESCROW_SEED), payer.publicKey.toBuffer()],

program.programId,

);

try {

const transaction = await program.methods

.deposit(ESCROW_AMOUNT, unlockPrice)

.accountsPartial({

user: payer.publicKey,

escrowAccount: escrow,

systemProgram: SystemProgram.programId,

})

.signers([payer])

.rpc();

await confirmTransaction(

provider.connection,

transaction,

CONFIRMATION_COMMITMENT,

);

const escrowAccount = await program.account.escrow.fetch(escrow);

const escrowBalance = await provider.connection.getBalance(

escrow,

CONFIRMATION_COMMITMENT,

);

console.log("Onchain unlock price:", escrowAccount.unlockPrice);

console.log("Amount in escrow:", escrowBalance);

assert(unlockPrice === escrowAccount.unlockPrice);

assert(escrowBalance > 0);

} catch (error) {

console.error("Error details:", error);

throw new Error(`Failed to create escrow: ${error.message}`);

}

};

it("creates Burry Escrow Below Current Price", async () => {

const solPrice: Big | null = await aggregatorAccount.fetchLatestValue();

if (solPrice === null) {

throw new Error("Aggregator holds no value");

}

// Although `SOL_USD_SWITCHBOARD_FEED` is not changing we are changing the unlockPrice in test as given below to simulate the escrow behavior

const unlockPrice = solPrice.minus(PRICE_OFFSET).toNumber();

await createAndVerifyEscrow(unlockPrice);

});

it("withdraws from escrow", async () => {

const [escrow] = PublicKey.findProgramAddressSync(

[Buffer.from(ESCROW_SEED), payer.publicKey.toBuffer()],

program.programId,

);

const userBalanceBefore = await provider.connection.getBalance(

payer.publicKey,

);

try {

const transaction = await program.methods

.withdraw()

.accountsPartial({

user: payer.publicKey,

escrowAccount: escrow,

feedAggregator: SOL_USD_SWITCHBOARD_FEED,

systemProgram: SystemProgram.programId,

})

.signers([payer])

.rpc();

await confirmTransaction(

provider.connection,

transaction,

CONFIRMATION_COMMITMENT,

);

// Verify escrow account is closed

try {

await program.account.escrow.fetch(escrow);

assert.fail("Escrow account should have been closed");

} catch (error) {

console.log(error.message);

assert(

error.message.includes("Account does not exist"),

"Unexpected error: " + error.message,

);

}

// Verify user balance increased

const userBalanceAfter = await provider.connection.getBalance(

payer.publicKey,

);

assert(

userBalanceAfter > userBalanceBefore,

"User balance should have increased",

);

} catch (error) {

throw new Error(`Failed to withdraw from escrow: ${error.message}`);

}

});

it("creates Burry Escrow Above Current Price", async () => {

const solPrice: Big | null = await aggregatorAccount.fetchLatestValue();

if (solPrice === null) {

throw new Error("Aggregator holds no value");

}

// Although `SOL_USD_SWITCHBOARD_FEED` is not changing we are changing the unlockPrice in test as given below to simulate the escrow behavior

const unlockPrice = solPrice.plus(PRICE_OFFSET).toNumber();

await createAndVerifyEscrow(unlockPrice);

});

it("fails to withdraw while price is below UnlockPrice", async () => {

const [escrow] = PublicKey.findProgramAddressSync(

[Buffer.from(ESCROW_SEED), payer.publicKey.toBuffer()],

program.programId,

);

try {

await program.methods

.withdraw()

.accountsPartial({

user: payer.publicKey,

escrowAccount: escrow,

feedAggregator: SOL_USD_SWITCHBOARD_FEED,

systemProgram: SystemProgram.programId,

})

.signers([payer])

.rpc();

assert.fail("Withdrawal should have failed");

} catch (error) {

console.log(error.message);

if (error instanceof AnchorError) {

assert.include(error.message, EXPECTED_ERROR_MESSAGE);

} else if (error instanceof Error) {

assert.include(error.message, EXPECTED_ERROR_MESSAGE);

} else {

throw new Error(`Unexpected error type: ${error}`);

}

}

});

});Once you're confident with the testing logic, run anchor test in your

terminal. You should see four tests pass.

burry-escrow

Onchain unlock price: 137.42243

Amount in escrow: 1058020

✔ creates Burry Escrow Below Current Price (765ms)

Account does not exist or has no data LxDZ9DXNwSFsu2e6u37o6C2T3k59B6ySEHHVaNDrgBq

✔ withdraws from escrow (353ms)

Onchain unlock price: 157.42243

Amount in escrow: 1058020

✔ creates Burry Escrow Above Current Price (406ms)

AnchorError occurred. Error Code: SolPriceBelowUnlockPrice. Error Number: 6003. Error Message: Current SOL price is not above Escrow unlock price..

✔ fails to withdraw while price is below UnlockPrice

4 passing (2s)If something goes wrong, review the lab and ensure everything is correct. Focus

on understanding the intent behind the code instead of just copying/pasting. You

can also review the working code on the

main branch of burry-escrow GitHub repository.

Challenge #

As an independent challenge, create a fallback plan if the data feed ever goes down. If the Oracle queue has not updated the aggregator account in X time or if the data feed account does not exist anymore, withdraw the user's escrowed funds.

A potential solution to this challenge can be found

in the Github repository on the challenge-solution branch.

Push your code to GitHub and tell us what you thought of this lesson!